Capital, Pricing and Reserving Models

Learn how your organization can benefit from Aon’s technology suite.

Deploy Capital Efficiently and Effectively

As the (re)insurance industry tackles inflation, rising catastrophe losses, climate change and geopolitical risks, insurers need financial modeling tools to understand the risks and identify the opportunities to deploy capital efficiently and effectively across the enterprise. This is where Aon’s Strategy and Technology Group steps in.

How Aon Can Help

Companies seeking to optimize their capital face numerous regulatory and operational constraints. At Aon, we provide a unified platform where clients can explore opportunities and respond confidently by being better informed and better advised, thanks to our dedicated team of technology professionals and actuaries.

Key Benefits

-

Operational Efficiencies

Increase operational efficiencies by replacing siloed legacy systems

-

Process Automation

More time for value-add activities through the automation of manual processes

-

Speed and Flexbility

Speed and flexibility for real-time decision making

Why Work with Us

-

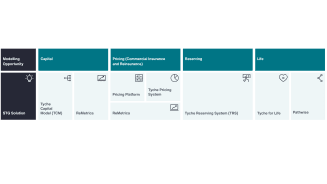

Technology Suite Across P&C and Life

Modeling Area:

- Capital

- Pricing

- Commercial Insurance

- Reinsurance

- Reserving

- Life

STG Solution:

- Tyche Capital Model

- Tyche Pricing System

- Tyche Reserving System

- Tyche for Life

- Pathwise

- ReMetrica

- Pricing Platform

-

Integrated Platform

An integrated platform across P&C and Life, including composites.

-

High-Speed Processing

High-speed processing to increase efficiency and make quicker business decisions: Reduced runtimes save money and reduce your carbon footprint. For example, a 100k simulation model run in Tyche takes 36 hours on the legacy platform, 3 hours without Hive on one server, and 33 minutes with Hive on four servers.

-

Team of Actuaries

Our team of 100 actuaries enhances and complements insight from our technology to optimize enterprise portfolios with services including risk management and regulatory (Solvency II and Bermuda primarily) plus ILS valuation and actuarial due diligence.

-

Secure Data Management

Robust controls for secure data management and protection with ISO27001, SOC 1 and SOC 2 certification.

100+

Our team of 100 actuaries enhances and complements insight from our technology to optimize enterprise portfolios with services including risk management and regulatory (Solvency II and Bermuda primarily) plus ILS valuation and actuarial due diligence.

Article 5 min read

How Can Insurers Identify Strategy Value in the Cloud?

STG leaders Alun Marriott and Peter Phillips set out to understand how the cloud can power advanced data analytics to help insurers better understand their portfolio mix, adjust their business strategy and deploy capital more effectively.